The Energy Bills Discount Scheme (EBDS) for businesses: What we know so far

27 January 2023 | 10 minutes

Discover more about the Energy Bills Discount Scheme (EBDS) for businesses.

The UK Government has now provided information about the financial support businesses may be able to receive once the Energy Bills Relief Scheme (EBRS) ends on 31 March 2023. A new 12-month package, the Energy Bill Discount Scheme (EBDS), will be available to non-domestic customers from 1 April 2023.

Coming at an estimated cost of £5.5 billion to Government, the new scheme will offer an energy bill discount to all businesses with qualifying consumption. It has been announced that Energy & Trade Intensive Industries (ETIIs) - detailed here, will be eligible to receive increased support. In its Press Release Government reported that this additional support will be subject to a limited application of the increased discount to 70% of volume however, details on how this will work in practice are still very limited. It is expected that ETIIs may need to submit an application with BEIS to receive the increased support – more detail is expected in due course.

All non-domestic customers in Great Britain will be eligible for the EBDS, provided they:

Have a fixed price energy contract, signed on or after 1 December 2021

Are in the process of signing a new fixed price contract

Are out of contract or deemed variable tariffs

Have a flexible purchase contract or similar

Government is continuing to encourage customers on flexible contracts to procure energy in the usual way

As with the existing EBRS, the support for non-ETIIs will be applied automatically to non-domestic customer accounts, with the discount detailed on bills accordingly.

Comparing EBDS and EBRS

While the finer details are still to be fully confirmed, it is expected that the EBDS will work in a similar way to the EBRS. For fixed contracts, a look-up table will be published by the Department for Business, Energy & Industrial Strategy (BEIS), this will provide a per-unit discount of energy based on the date the contracted was signed.

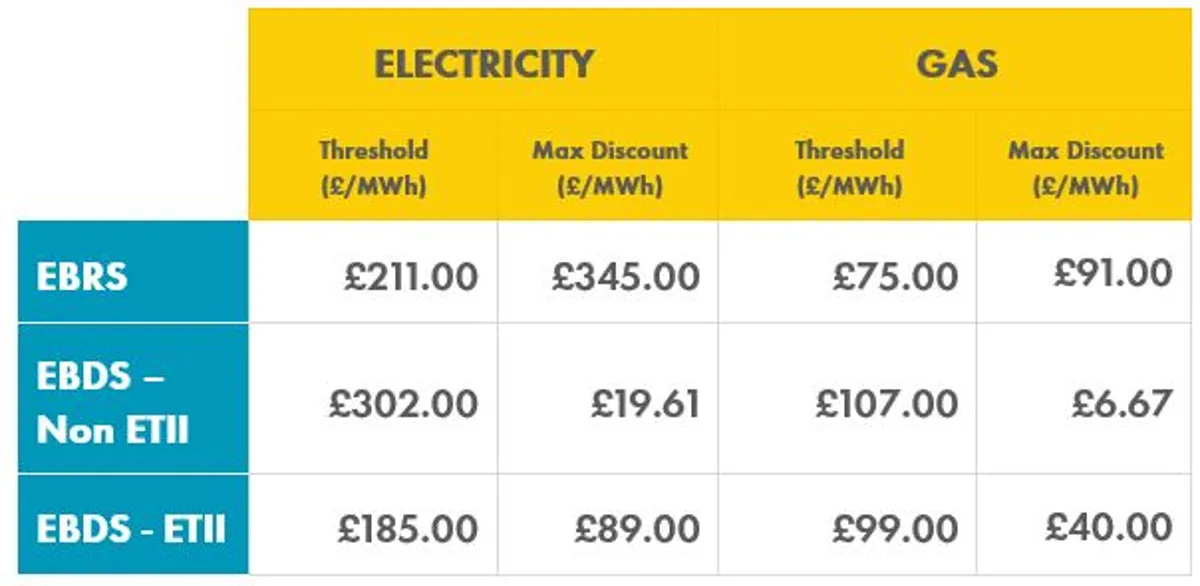

As with the EBRS, this discount will be based on a Wholesale Reference Price calculated by Government and the discount will be applied. The threshold below which customers will not receive any discount is increasing quite significantly from £211/MWh to £302/MWh (30.2p/kWh) under EBDS (normal) for electricity and from £75/MWh to £107/MWh (10.7p/kWh) for gas.

Unlike the EBRS, all EBDS support will now be subject to a cap (a maximum discount). The electricity discount received will be capped at £19.61/MWh (1.961 p/kWh) and the gas maximum discount will be £6.97/MWh (0.697p/kWh). Under EBRS there was no cap for fixed rate contracts. This will mean that some customers currently receiving high discounts, will see a significant reduction in support. It is expected that the support for Flexible, Deemed and Extended Supply customers will work in the same way as the EBRS but updated with the new thresholds and caps (maximum discounts).

If your business qualifies as an ETII, it may be eligible for some additional support in the form of a lower wholesale threshold, set at £185/MWh (18.5p/kWh) for electricity and £99/MWh (9.9p/kWh) for gas. You would also qualify for a larger maximum discount of £89/MWh (8.9p/kWh) for electricity, and £40/MWh (4.0p/kWh) for gas. It is expected that this will be applied to 70% of volume with the remainder receiving standard EBDS support (if eligible). We await confirmation of this and the specific technical details from Government.

The table on the left shows the standard (non-ETII) EBDS and EBDS ETII compared to EBRS. Businesses with wholesale energy costs below these thresholds won’t receive EBDS support.

It’s important to note that this support is considerably reduced compared to EBRS. Where some businesses were previously receiving support through the EBRS, this new scheme may take some businesses and organisations out of scope entirely. Further to this, some businesses who were receiving large discounts under the EBDS could see a significant reduction in support through the EBRS.

Please note: EBDS and EBDS-ETII remains an evolving scheme and they are subject to final confirmation by Government. The information outlined in this update is correct at the time of publication and does not constitute legal guidance or advice.

The Government has provided illustrative examples of the different levels of support based on recent averages of forward wholesale prices:

Example 1: A pub

A typical pub uses 16 MWh of gas and 4 MWh of electricity each month. Under the new scheme, it could receive up to £2,280 of taxpayer funded support in the 23/24 financial year.

Example 2: A small retail shop

A typical small retail store uses 2 MWh of gas and 1 MWh of electricity each month. Under the new scheme, it could receive up to £403 of taxpayer funded support in the 23/24 financial year.

Example 3: A medium sized manufacturing business

A medium sized manufacturer uses 1,600 MWh of gas and 200 MWh of electricity each month. Under the new ETII scheme, it could receive up to £687,120 of taxpayer funded support in the 23/24 financial year. We will continue to monitor the scheme and provide further specific information to our business energy customers as developments are announced.

What else can businesses do to reduce energy costs?

With less support available, businesses will once again be looking at their options to better manage costs. Close scrutiny of energy consumption across operations is an essential, and one that will help to identify targeted actions that can deliver savings. Here’s some suggestions on how businesses can reduce energy consumption in a bid to try and lower their energy expenditure.

Installing smart technologies to understand how your business is using energy is an important first step. Consider eliminating wasted energy by sensing when rooms, or equipment are not in use and automatically switching energy sources off as a way of achieving savings quickly. Investigating equipment performance to optimise efficiency can also prompt maintenance or upgrades that can deliver energy savings.

Changing shift patterns and operations to optimise night-time tariffs, turning down thermostats, maximising use of natural light, switching off IT equipment, printers, copiers and water chillers in periods of downtime (such as overnight and at weekends) can save significant amounts over a year when done on a large enough scale. Even reducing pressure on compressed air units and checking for leaks can save money.

Looking at how to maximise the capacity on equipment like ovens or heating tanks so they are not running half empty, or monitoring freezers and cold rooms to minimise gaps for warm air and ensure doors are fully closed, can contribute to significant savings over time.

A commitment to energy efficiency not only helps to reduce bills in the long-term, but it can also give you measurable performance data that will help to unlock funding for future investment in more efficient equipment or on-site renewables. You can find your more about ways to help manage your business’ energy costs from our latest webinar and our energy solutions information page.

View our online content disclaimer.